Our family has certainly has its ups and downs with finances over the decades.

We’ve pulled ourselves out of debt a few times only to find ourselves soon drowning again over vet bills or car trouble or another emergency.

My military husband had a few scary times when there were furloughs or job cuts. When he retired, there have been struggles with keeping civilian employment.

I can’t imagine the stress my kids’ peers and cousins have with struggling financially while navigating higher education, finding a career, learning adult relationships, figuring out transportation and healthcare.

I refuse to force my children to navigate their lives on a rollercoaster of debt and vibes. I have the privilege of providing them a legacy and I will launch them into successful futures.

We’ve had a few windfalls that helped us completely change our lifestyle and goals.

My husband and his two sisters received three large disbursements and an annual dividend from their aunt and mom, and we sure do appreciate their foresight and generosity.

My husband received 100% VA disability rating and that provides for our kids’ futures and educations.

It was shocking dealing with my husband’s parents’ deaths twenty years ago and realizing how little they had planned for retirement. Then, in December I became the caregiver for my parents and was devastated to realize how they had hoarded money for decades while claiming they had nothing. They didn’t invest or plan wisely; they lived in fear. In July, my father’s death threw us into a whirlwind of paperwork. Luckily, they have no real assets, so nothing goes to probate.

My husband and I set up a trust for our four children so there are no surprises or concerns in case of emergencies. I don’t want anything to have to go through probate court.

Partner with a financial advisor. There is so much that I don’t understand. I don’t have accounting or financial training and that is literally what our annual fee at our banking institution provides – annual meetings for review and advice for future planning for our entire family.

We are helping prepare our kids for an uncertain future with financial education and investments.

10 Ways for Teens to Achieve Financial Success

- Get a part time job.

- I encourage my teens to work outside our home as soon as they think they can handle it. Two of my kids chose to do so about age 15-16 and one waited until age 18. My son will probably get a job when he turns 16, if he can manage with his school and sports schedule.

- Open bank accounts.

- Credit unions will have lower or no fees, better customer service, higher savings interest rates, and lower loan rates.

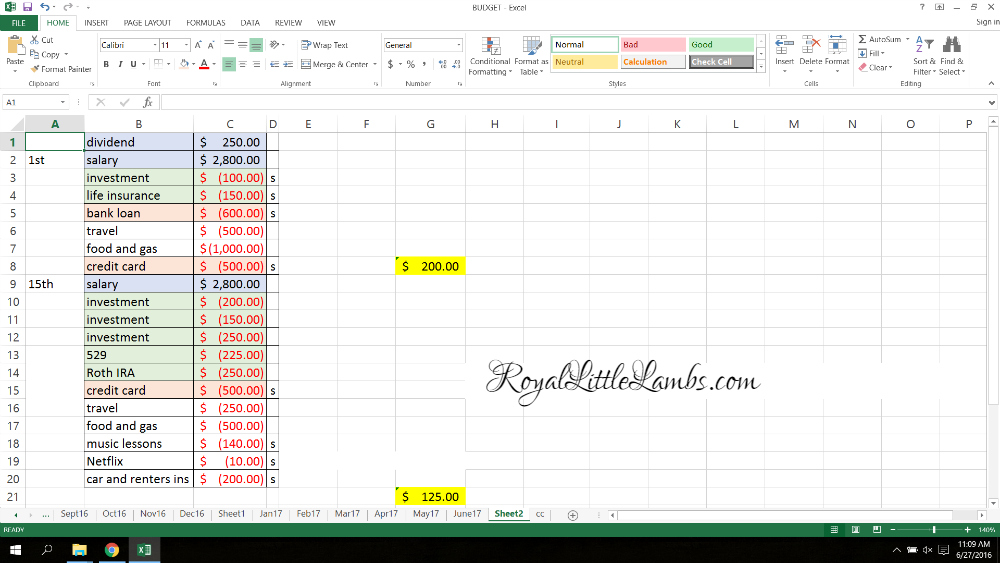

- Learn how to budget.

- Kids can begin with the 50-30-20 (or even more aggressively tiered towards savings and investing if they’re able)

- 50% income for expenses

- 30% towards wants

- 20% towards savings and investing or debt

- Zero debt education planning

- Invest towards higher education as soon as possible

- Apply for financial aid if applicable

- Apply for scholarships – even the little ones can add up

- Work-study programs

- Try to avoid high interest student loans whenever possible

- Add as authorized user on parent credit card.

- Be smart with credit and use points or cash back cards

- Pay off debts each month so never accrue interest debt

- Joint auto loans

- There are hardly starter cars available anymore! A joint auto loan helps build a credit history and gives teens a goal.

- Roth IRA

- We try to invest the max allowed each year according to income

- Compound growth over decades. Tax-free retirement income.

- Can withdraw original contributions at any time

- Withdrawals before age 59 1/2 may incur taxes and penalties

- High interest savings accounts

- Better than a traditional savings account, but often requires a larger balance to maintain

- Money market accounts have higher interest rates than regular banking accounts

- CD in increments of 6, 12, 18+ months has protected interest rates for those time frames

- Investment funds

- These are great to invest towards a financially free future and retirement. What’s the difference between stocks, bonds, and index funds?

- Each of my kids receive $10k to begin investing towards a future home purchase, etc.

- Legal paperwork

- Once a child is 18, parents cannot legally make decisions anymore

- Life insurance, HIPAA release, Health Care Proxy, Power of Attorney, FERPA Waiver, Will

Bonus tips:

- Learn SKILLS – EQ, communication, marketing, sales, computers, etc. Formal education is NOT enough.

- Surround yourself with like-minded people who share similar values and goals.

- Don’t drink alcohol, especially in clubs or bars. It’s expensive and disrupts your health.

- Don’t do drugs. Be careful even with prescription drugs. We don’t even understand the long-term effects of some heavily prescribed medicines.

- Maintain your physical health. Walk. Go to the gym. Eat well. Get enough sleep.

- Care for your mental health. Manage stress. Go to therapy. Work through your triggers or trauma.

If you’re not around to enjoy the fruits of your labor, what’s the point?

We have experienced immense financial changes in the past year. We had four car payments, a mortgage, and credit card debt. We had little savings, but several investments from the beginning, even if regularly depositing into them had been put on hold. My husband lost two jobs after retiring from the Air Force. My eldest daughter had a lemon car with a lien we had to pay off and has struggled with jobs for a couple years.

I understand that too many families struggle living paycheck to paycheck and experience mountainous debt with medical bills or other financial burdens. Our society strives to keep us as slaves to debt. There is no real way to save when we are in survival mode.

We invest our money now so we can have the freedom to walk away from situations we don’t like in the future. ~Call to Leap

Resources:

- The Simple Path to Wealth by J L Collins

- The Algebra of Wealth by Scott Galloway

- Secrets of a Millionaire Mind by T. Harv Eker

- Think and Grow Rich by Napoleon Hill

- The Little Book of Common Sense Investing by John C. Bogle

- The Millionaire Next Door by Thomas J. Stanley, Ph.D. and William D. Danko, Ph.D

- The Psychology of Money by Morgan Housel

- The Soul of Money by Lynne Twist

- Bogleheads

- Investopedia

- NerdWallet

- Morningstar

- Marketwatch

You might also like: